Our weekly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

- Top 10 Loan Price Winners

- Top 10 Loan Price Losers

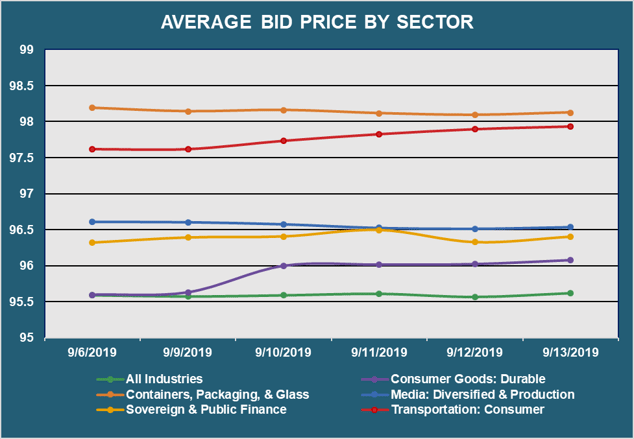

- Average Bid Price (By industry sector)

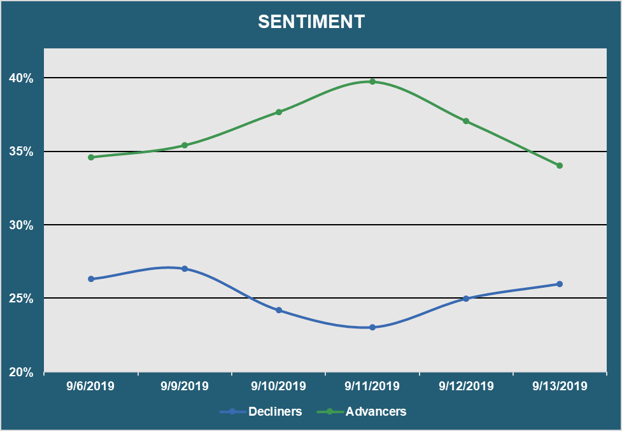

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

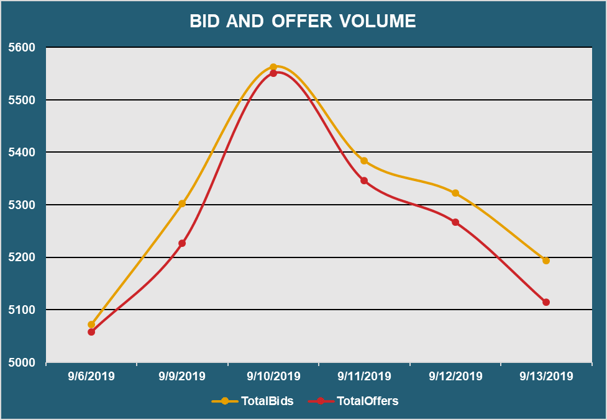

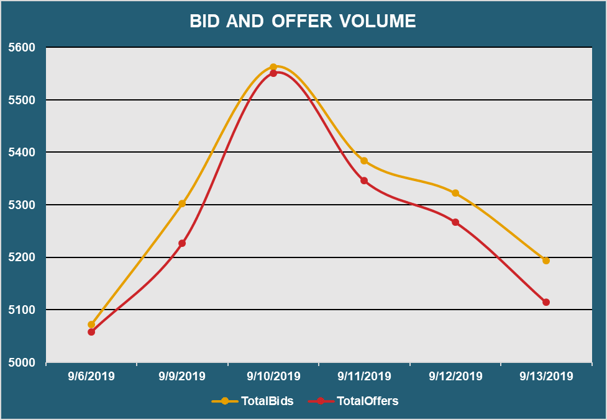

- Bid and Offer Volume

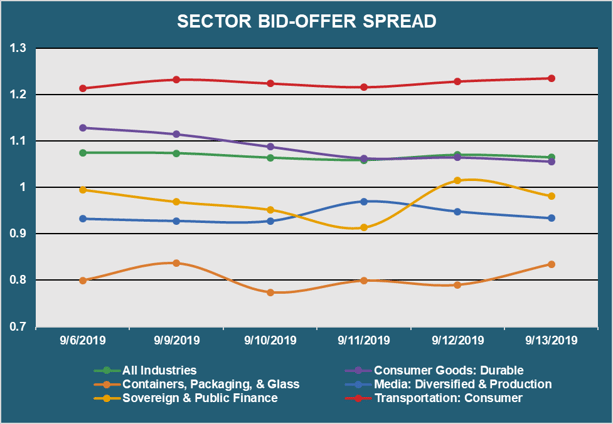

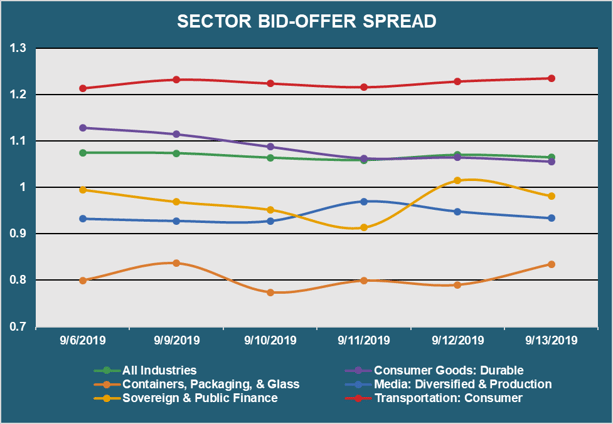

- Bid Offer Spread (By industry sector)

| TOP 10 WINNERS |

| Rank |

Loan |

Chg |

Price |

Price - 1W |

| 1 |

DITECH EXIT TL B |

27.26% |

35.47 |

27.87 |

| 2 |

MCS TL B |

9.98% |

39.70 |

36.10 |

| 3 |

TEAM HEALTH TL |

3.73% |

83.53 |

80.53 |

| 4 |

EXGEN RENEWABLES I TL B |

2.99% |

98.50 |

95.64 |

| 5 |

STAPLES TL B1 |

2.77% |

98.85 |

96.19 |

| 6 |

RADIOLOGY PARTNERS TL |

2.16% |

98.07 |

96.00 |

| 7 |

MONTREIGN RESORT CASINO TL |

2.11% |

89.87 |

88.01 |

| 8 |

ORTHO-CLINICAL TL B |

1.72% |

96.35 |

94.72 |

| 9 |

MULTIPLAN TL B |

1.70% |

94.74 |

93.15 |

| 10 |

MOMENTIVE PERFORMANCE MATLS TL B |

1.29% |

98.50 |

97.25 |

- Showcases the top 10 loan "winners" based on the largest bid price increases between 9/6/19 - 9/13/19

| TOP 10 LOSERS |

| Rank |

Loan |

Chg |

Price |

Price - 1W |

| 1 |

SERTA SIMMONS 2ND LIEN TL |

-15.03% |

36.75 |

43.24 |

| 2 |

ACCUVANT 2ND LIEN TL |

-13.64% |

56.28 |

65.16 |

| 3 |

ANCHOR GLASS 2ND LIEN TL |

-13.31% |

60.45 |

69.74 |

| 4 |

P.F. CHANG'S TL |

-6.86% |

83.82 |

90.00 |

| 5 |

MURRAY ENERGY TL B2 |

-4.90% |

44.64 |

46.95 |

| 6 |

IMAGINE! TL |

-4.86% |

74.32 |

78.11 |

| 7 |

LONGVIEW POWER EXIT TL B |

-4.62% |

79.16 |

83.00 |

| 8 |

GENON ENERGY INC TL B |

-4.43% |

91.49 |

95.73 |

| 9 |

FORESIGHT ENERGY TL |

-3.70% |

62.57 |

64.97 |

| 10 |

SKILLSOFT EXT TL |

-3.38% |

80.33 |

83.14 |

- Showcases the top 10 loan "losers" based on the largest bid price decreases between 9/6/19 - 9/13/19

- Displays the average loan bid price by sector between 9/6/19 - 9/13/19

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 9/6/19 - 9/13/19

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK |

| RANK |

TRANCHE |

PRIOR WEEK

|

THIS WEEK

|

INCREASE |

% INCREASE |

| 1 |

EIRCOM FINCO SARL EUR TL B |

14 |

57 |

43 |

307% |

| 2 |

CENGAGE TL |

42 |

70 |

28 |

67% |

| 3 |

ROYALTY PHARMA TL B6 |

30 |

55 |

25 |

83% |

| 4 |

TRANSUNION TL B4 |

37 |

62 |

25 |

68% |

| 5 |

VIZIENT TL B |

14 |

38 |

24 |

171% |

| 6 |

ACADIA HEALTHCARE TL B4 |

28 |

52 |

24 |

86% |

| 7 |

APEX TOOLS TL B |

24 |

48 |

24 |

100% |

| 8 |

CAPITAL AUTOMOTIVE TL B |

42 |

66 |

24 |

57% |

| 9 |

IMS HEALTH TL B1 |

34 |

58 |

24 |

71% |

| 10 |

ACADIA HEALTHCARE TL B3 |

30 |

53 |

23 |

77% |

- Exhibits the loans with the largest increase in quote volume for the week ending 9/6/19 vs. the week ending 9/13/19

| MOST QUOTED LOANS |

| RANK |

TRANCHE |

DEALERS |

| 1 |

DELL TL B |

14 |

| 2 |

EIRCOM FINCO SARL EUR TL B3 |

12 |

| 3 |

JCREW TL B |

10 |

| 4 |

UNILABS EUR TL B |

10 |

| 5 |

ALLISON TRANSMISSION TL B |

10 |

| 6 |

ESH HOSPITALITY TL B |

10 |

| 7 |

ZIGGO EUR TL F |

9 |

| 8 |

ALTICE FINANCING TL B |

9 |

| 9 |

COOPER STANDARD TL B |

9 |

| 10 |

GRIFOLS WORLDWIDE TL B |

9 |

- Ranks the loans that were quoted by the highest number of dealers between 9/6/19 - 9/13/19

- Reveals the total number of quotes by bid and offer between 9/6/19 - 9/13/19

- Displays the bid-offer spread by sector between 9/6/19 - 9/13/19

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.