Our weekly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

- Top 10 Loan Price Winners

- Top 10 Loan Price Losers

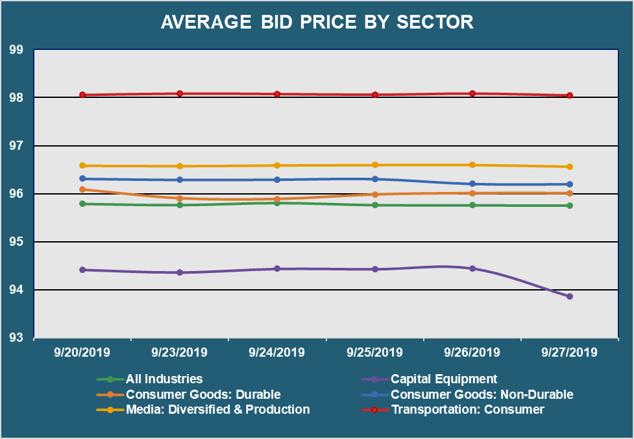

- Average Bid Price (By industry sector)

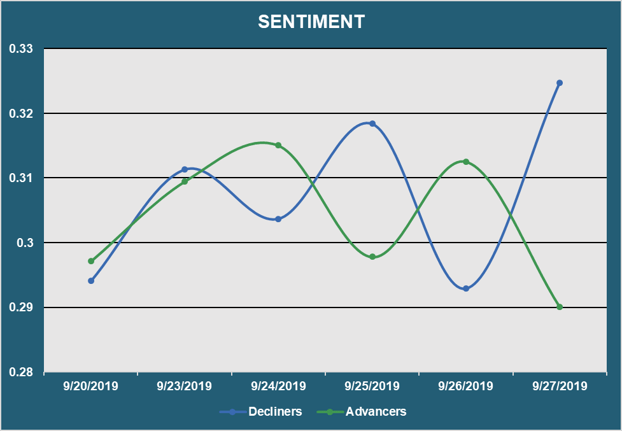

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

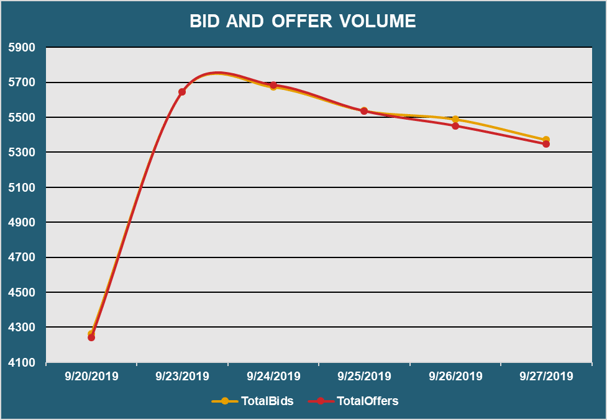

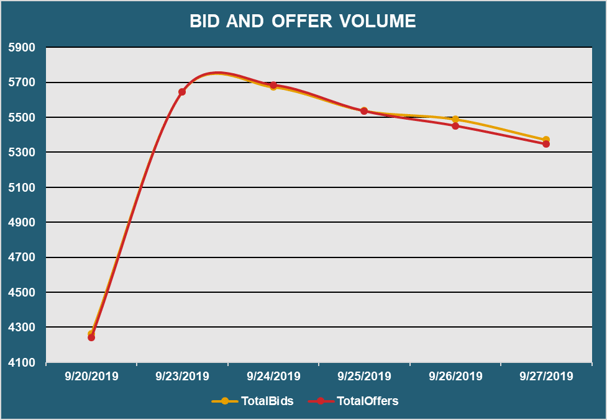

- Bid and Offer Volume

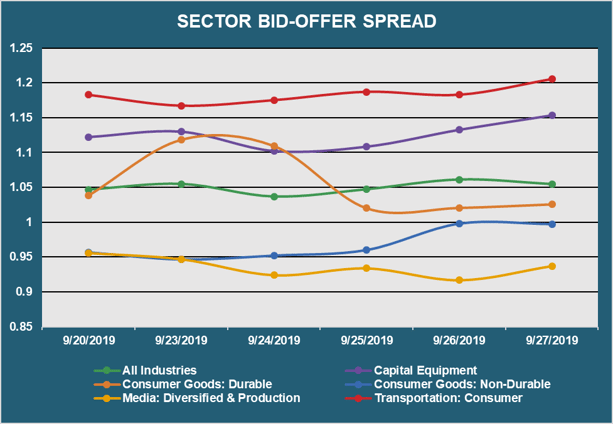

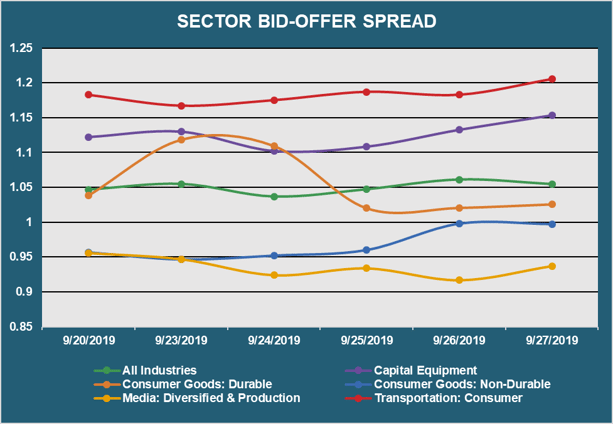

- Bid Offer Spread (By industry sector)

| TOP 10 WINNERS |

| Rank |

Loan |

Chg |

Price |

Price - 1W |

| 1 |

SURVITEC GBP TL |

6.37% |

67.35 |

63.32 |

| 2 |

MCS TL B |

2.93% |

43.12 |

41.89 |

| 3 |

FLINT GROUP TL C |

2.71% |

84.11 |

81.89 |

| 4 |

HEALTHPORT TL B |

1.81% |

91.10 |

89.48 |

| 5 |

CONVERGEONE TL B |

1.71% |

89.45 |

87.94 |

| 6 |

PETCO TL B |

1.44% |

75.46 |

74.39 |

| 7 |

OGF SA EUR TL B |

1.37% |

94.17 |

92.90 |

| 8 |

ACADEMY SPORTS TL B |

1.35% |

69.98 |

69.05 |

| 9 |

SLV GROUP GMBH EUR TL B |

1.34% |

91.63 |

90.42 |

| 10 |

EAGLEVIEW TL B |

1.10% |

96.08 |

95.04 |

- Showcases the top 10 loan "winners" based on the largest bid price increases between 9/20/19 - 9/27/19

| TOP 10 LOSERS |

| Rank |

Loan |

Chg |

Price |

Price - 1W |

| 1 |

JO-ANN STORES 2ND LIEN TL |

-41.11% |

30.00 |

50.94 |

| 2 |

IMAGINE! 2ND LIEN TL |

-26.51% |

46.12 |

62.75 |

| 3 |

MCDERMOTT TL B |

-8.71% |

63.96 |

70.06 |

| 4 |

SEADRILL PARTNERS LLC EXT TL B |

-7.23% |

55.22 |

59.52 |

| 5 |

ONE CALL EXT TL B |

-5.55% |

79.65 |

84.33 |

| 6 |

BELK TL B |

-4.88% |

73.09 |

76.84 |

| 7 |

PRINCE TL |

-4.03% |

80.08 |

83.44 |

| 8 |

LUMILEDS DD TL |

-3.93% |

47.26 |

49.19 |

| 9 |

V GROUP TL B |

-3.58% |

75.98 |

78.80 |

| 10 |

KCA DEUTAG TL B |

-3.43% |

63.36 |

65.62 |

- Showcases the top 10 loan "losers" based on the largest bid price decreases between 9/20/19 - 9/27/19

- Displays the average loan bid price by sector between 9/20/19 - 9/27/19

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 9/20/19 - 9/27/19

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK |

| RANK |

TRANCHE |

PRIOR WEEK

|

THIS WEEK

|

INCREASE |

% INCREASE |

| 1 |

DOMIDEP EUR TL B |

12 |

47 |

35 |

292% |

| 2 |

DAVITA TL B |

42 |

66 |

24 |

57% |

| 3 |

EIRCOM FINCO SARL EUR TL B |

64 |

83 |

19 |

30% |

| 4 |

ADVANTAGE SALES TL B2 |

49 |

68 |

19 |

39% |

| 5 |

FORTRESS TL B |

33 |

52 |

19 |

58% |

| 6 |

IPH GROUP EUR TL |

38 |

57 |

19 |

50% |

| 7 |

ALBANY MOLECULAR 2ND LIEN TL |

8 |

26 |

18 |

225% |

| 8 |

VERITAS EUR TL B |

40 |

58 |

18 |

45% |

| 9 |

THE NIELSEN COMPANY B.V. TL B |

51 |

68 |

17 |

33% |

| 10 |

GARDNER DENVER EUR TL B |

29 |

46 |

17 |

59% |

- Exhibits the loans with the largest increase in quote volume for the week ending 9/20/19 vs. the week ending 9/27/19

| MOST QUOTED LOANS |

| RANK |

TRANCHE |

DEALERS |

| 1 |

DELL TL B |

13 |

| 2 |

MCDERMOTT TL B |

12 |

| 3 |

PROTECTION1 TL B |

12 |

| 4 |

JCREW TL B |

11 |

| 5 |

SERTA SIMMONS TL |

11 |

| 6 |

CABLEVISION TL B |

11 |

| 7 |

MALLINCKRODT TL B |

11 |

| 8 |

WYNN LAS VEGAS LLC / WYNN LAS TL |

11 |

| 9 |

SHUTTERFLY TL B2 |

11 |

| 10 |

DITECH EXIT TL B |

10 |

- Ranks the loans that were quoted by the highest number of dealers between 9/20/19 - 9/27/19

- Reveals the total number of quotes by bid and offer between 9/20/19 - 9/27/19

- Displays the bid-offer spread by sector between 9/20/19 - 9/27/19

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.