We are excited to launch a weekly newsletter to highlight trends in the Municipal Bond market. Our newsletter presents key trends derived from observable Municipal Bond pricing data over a weekly period.

- Top 10 Muni Bond Winners & Losers

- Top 10 Muni State Winners & Losers

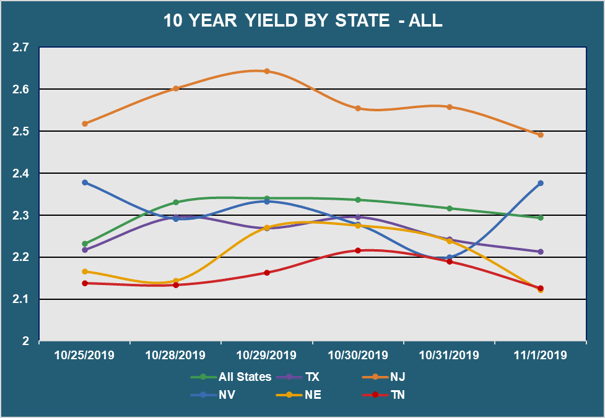

- 10 Yr Yield by State - All Muni

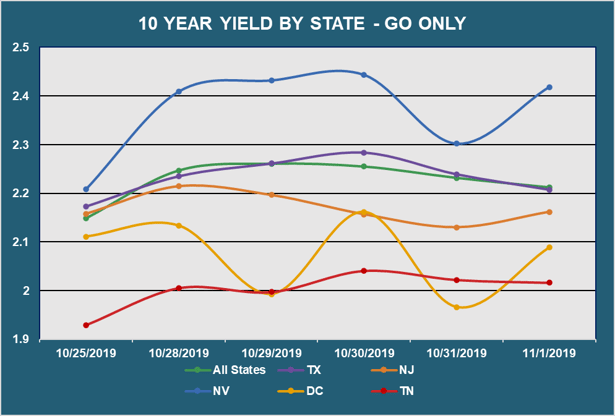

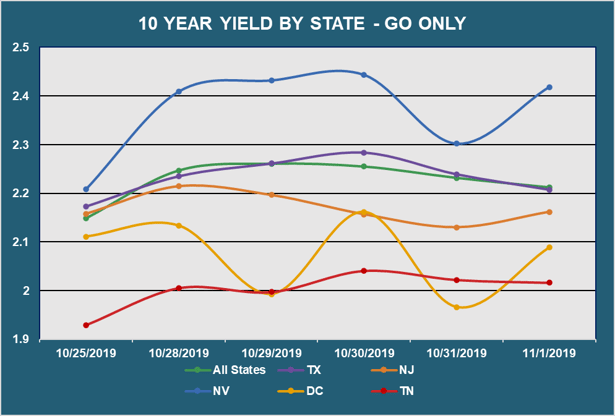

- 10 Yr Yield by State - GO Only

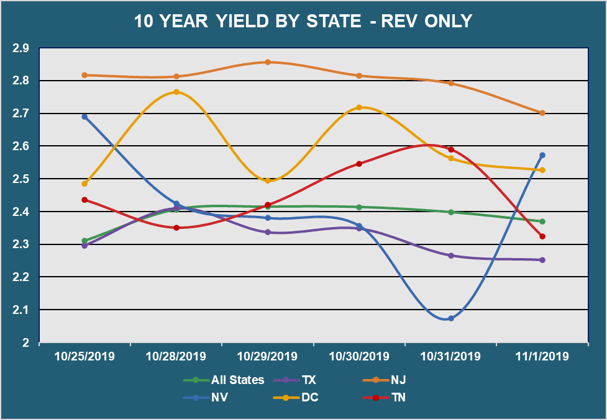

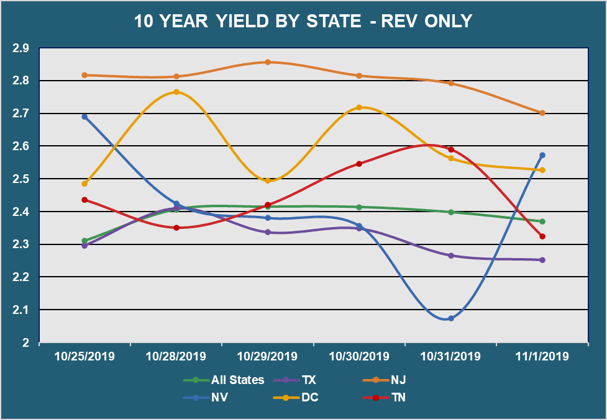

- 10 Yr Yield by State - REV Only

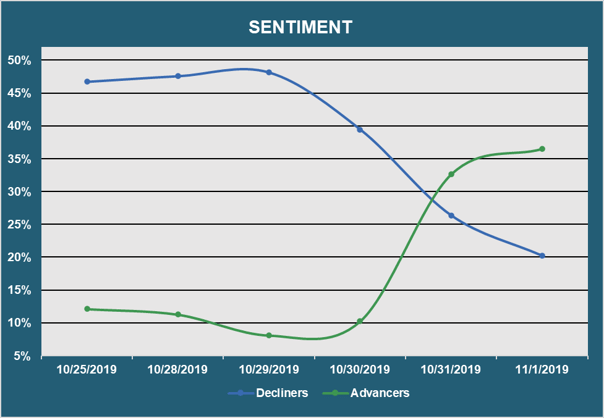

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Municipal Bonds

| TOP 10 BOND WINNERS |

| Rank |

Bond Name |

Coupon |

Maturity |

Chg |

Price |

Price - 1W |

| 1 |

PR COMWLTH-IMPT-A |

5.25% |

07/01/24 |

5.42% |

76.96 |

73.00 |

| 2 |

OH TPK COMMN-A-BHAC-C |

5.50% |

02/15/24 |

5.35% |

122.59 |

116.37 |

| 3 |

MI TECH UNIV-A-BAB |

6.44% |

10/01/29 |

3.93% |

126.56 |

121.77 |

| 4 |

GRAND RAPIDS SAN-A-BA |

6.72% |

01/01/41 |

3.02% |

151.83 |

147.37 |

| 5 |

TWENTYNINE REDEV-A |

4.25% |

09/01/42 |

2.79% |

110.60 |

107.59 |

| 6 |

KANE CO SD #131-B |

4.15% |

06/01/41 |

2.61% |

110.97 |

108.14 |

| 7 |

MET TRN AUTH-A2-BABS |

6.09% |

11/15/40 |

2.12% |

139.16 |

136.28 |

| 8 |

METRO TRANSP AUTH-A1 |

3.00% |

11/15/34 |

2.07% |

104.83 |

102.70 |

| 9 |

KING CO HSG AUTH |

3.00% |

11/01/39 |

2.04% |

101.31 |

99.29 |

| 10 |

KS ST DEV EMPLOYEES-C |

5.50% |

05/01/34 |

1.99% |

127.50 |

125.02 |

| TOP 10 BOND LOSERS |

| Rank |

Bond Name |

Coupon |

Maturity |

Chg |

Price |

Price - 1W |

| 1 |

PR ELEC SER TT |

5.00% |

07/01/25 |

-10.47% |

70.06 |

78.25 |

| 2 |

ROSEMEAD-A-REF |

3.13% |

08/01/43 |

-4.90% |

94.25 |

99.11 |

| 3 |

SAN MATEO SD-A-CABS |

0.00% |

09/01/33 |

-4.61% |

95.28 |

99.88 |

| 4 |

FORT BEND CO MUD #134 |

2.63% |

09/01/41 |

-4.38% |

91.83 |

96.04 |

| 5 |

EMPLOYEES RETIREMT-A |

6.15% |

07/01/38 |

-2.89% |

42.10 |

43.35 |

| 6 |

LAWRENCEBURG TN -B |

2.13% |

06/01/33 |

-2.75% |

96.31 |

99.03 |

| 7 |

KINGS PARK CSD |

2.00% |

09/01/34 |

-2.68% |

94.20 |

96.79 |

| 8 |

BERKS CO IDA HLTH-REF |

3.75% |

11/01/42 |

-2.67% |

102.44 |

105.25 |

| 9 |

FAIRVIEW HGTS |

3.50% |

12/01/43 |

-2.59% |

104.24 |

107.01 |

| 10 |

PA TURNPIKE COMM -A-1 |

5.00% |

12/01/26 |

-2.51% |

118.40 |

121.45 |

- Showcases the top 10 Muni Bond "Winners" and "Losers" based on price movements between 10/25/19 - 11/1/19

| TOP 10 STATE WINNERS |

| Rank |

State Name |

Chg |

Yld |

Yld - 1W |

| 1 |

GA |

-29 bps |

1.72% |

2.02% |

| 2 |

SC |

-14 bps |

1.99% |

2.12% |

| 3 |

HI |

-11 bps |

2.15% |

2.26% |

| 4 |

CO |

-10 bps |

2.02% |

2.12% |

| 5 |

WI |

-9 bps |

2.18% |

2.27% |

| 6 |

VA |

-8 bps |

1.92% |

2.00% |

| 7 |

MN |

-8 bps |

2.03% |

2.11% |

| 8 |

MS |

-7 bps |

2.18% |

2.25% |

| 9 |

KY |

-6 bps |

2.43% |

2.50% |

| 10 |

OR |

-6 bps |

2.09% |

2.15% |

| TOP 10 STATE LOSERS |

| Rank |

State Name |

Chg |

Yld |

Yld - 1W |

| 1 |

MO |

88 bps |

2.24% |

1.36% |

| 2 |

AZ |

74 bps |

2.77% |

2.03% |

| 3 |

IL |

58 bps |

3.08% |

2.50% |

| 4 |

LA |

34 bps |

2.36% |

2.02% |

| 5 |

IN |

31 bps |

2.50% |

2.19% |

| 6 |

NV |

21 bps |

2.42% |

2.21% |

| 7 |

MT |

18 bps |

2.03% |

1.85% |

| 8 |

KS |

15 bps |

2.34% |

2.19% |

| 9 |

MI |

13 bps |

2.46% |

2.34% |

| 10 |

ME |

12 bps |

1.92% |

1.80% |

- Showcases the top 10 Muni State "Winners" and "Losers" based on yield movements between 10/25/19 - 11/1/19

- Displays the average Muni 10 year yield by state between 10/25/19 - 11/1/19 (General Obligation and Revenue Bonds)

- Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

- Displays the average Muni 10 year yield by state between 10/25/19 - 11/1/19 (General Obligation Bonds only)

- Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

- Displays the average Muni 10 year yield by state between 10/25/19 - 11/1/19 (Revenue Bonds only)

- Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

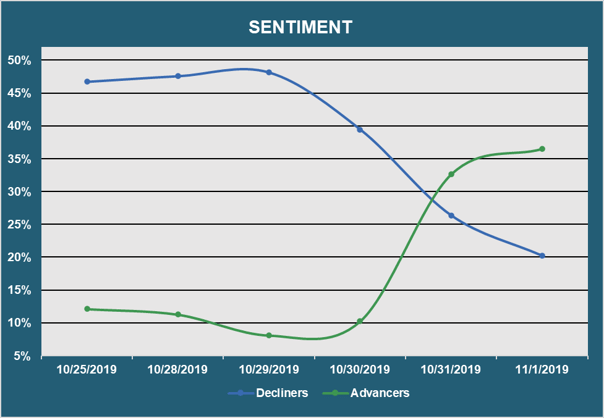

- Reveals the percent of Muni bonds increasing in price (Advancers) vs. decreasing in price (Decliners) between 10/25/19 - 11/1/19

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK |

| RANK |

TRANCHE |

COUPON |

MATURITY |

PRIOR WEEK

|

THIS WEEK

|

INCREASE |

% INCREASE |

| 1 |

CA EDU FACS AUTH-U6 |

5.00% |

05/01/45 |

4 |

46 |

42 |

1050% |

| 2 |

HONOLULU CO-B-REF |

5.00% |

10/01/29 |

6 |

45 |

39 |

650% |

| 3 |

LOS ANGELES REDEV-C |

5.25% |

12/01/25 |

12 |

45 |

33 |

275% |

| 4 |

OR HSG AND CMNTY-D |

4.75% |

01/01/50 |

5 |

37 |

32 |

640% |

| 5 |

PA TPK COMM-A-SUB-1 |

5.25% |

12/01/45 |

8 |

39 |

31 |

388% |

| 6 |

WI HEALTH & EDUCATION |

5.00% |

04/01/25 |

7 |

35 |

28 |

400% |

| 7 |

NEW YORK CITY-C-REF |

5.00% |

08/01/27 |

5 |

30 |

25 |

500% |

| 8 |

MINNESOTA ST-B |

5.00% |

08/01/24 |

5 |

30 |

25 |

500% |

| 9 |

OREGON ST DEPT OF ADM |

5.00% |

04/01/29 |

7 |

32 |

25 |

357% |

| 10 |

DASNY-REV-A-GRP 4-REF |

5.00% |

03/15/45 |

30 |

54 |

24 |

80% |

- Exhibits the Munis with the largest increase in quote volume for the week ending 10/25/19 vs. the week ending 11/1/19

| MOST QUOTED MUNIS |

| RANK |

TRANCHE |

COUPON |

MATURITY |

DEALERS |

| 1 |

NY ST THRUWAY AUTH-B |

3.00% |

01/01/46 |

20 |

| 2 |

COLUMBUS OH |

5.00% |

04/01/36 |

15 |

| 3 |

CA EDU FACS AUTH-U6 |

5.00% |

05/01/45 |

14 |

| 4 |

CHARLESTON CO SC-B |

5.00% |

11/01/30 |

14 |

| 5 |

COLUMBUS OH |

5.00% |

04/01/38 |

14 |

| 6 |

CALIFORNIA |

5.00% |

10/01/27 |

14 |

| 7 |

WASHINGTON DC MET-B |

5.00% |

07/01/36 |

13 |

| 8 |

NY ST THRUWAY AUTH-B |

4.00% |

01/01/50 |

13 |

| 9 |

NEW YORK NY-B-1 |

3.00% |

10/01/44 |

13 |

| 10 |

INDIANA FIN AUTH |

5.00% |

02/01/28 |

13 |

- Ranks the Munis that were quoted by the highest number of dealers between 10/25/19 - 11/1/19

Want free access to Solve's Real-Time Market Data and trends within the market for Municipal Bonds?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.