Solve Advisor's weekly loan newsletter highlights trends in the Syndicated Bank Loan market.

Want to receive Solve's Bank Loan summaries in your inbox directly?

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

Solve has aggregated and organized key trends derived from observable loan price data for the period between Friday, June 8th - Friday, June 15th. In the tables and charts below, you'll find:

- Top 10 Loan Price Winners

- Top 10 Loan Price Losers

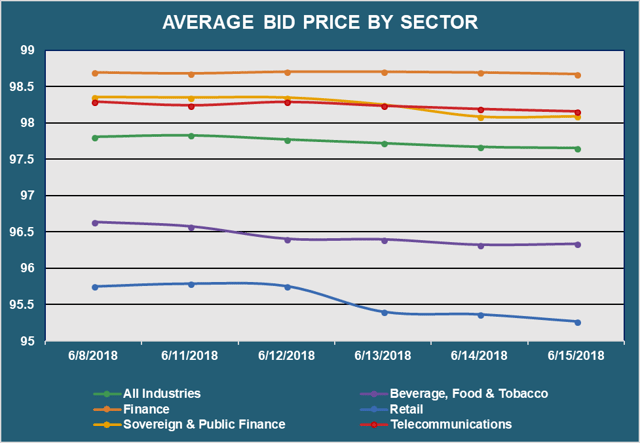

- Average Bid Price (By industry sector)

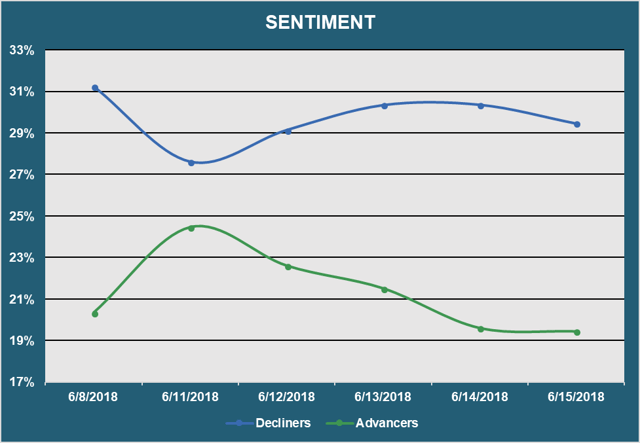

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

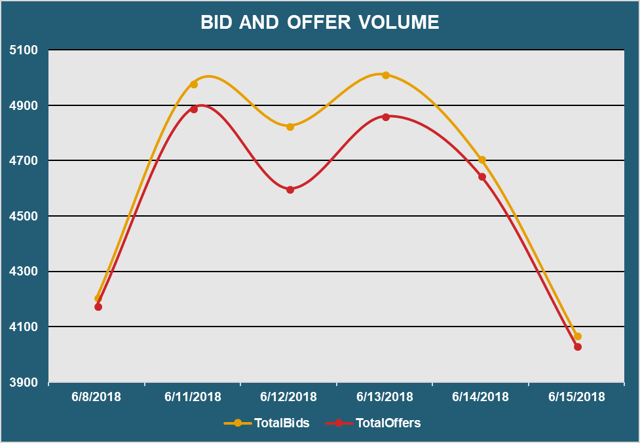

- Bid and Offer Volume

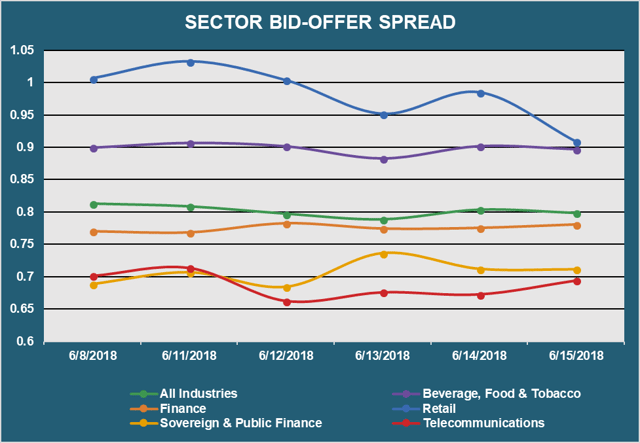

- Bid Offer Spread (By industry sector)

- Showcases the top 10 loan "winners" based on the largest bid price increases for the period between 6/8/18 - 6/15/18

- Showcases the top 10 loan "losers" based on the largest bid price decreases for the period between 6/8/18 - 6/15/18

- Displays the average loan bid price by sector for the period between 6/8/18 - 6/15/18

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) for the period between 6/8/18 - 6/15/18

- Exhibits the loans with the largest increase in quote volume for the week ending 6/8/18 vs. the week ending 6/15/18

- Ranks the loans that were quoted by the highest number of dealers for the period between 6/8/18 - 6/15/18

- Reveals the total number of quotes by bid and offer for the period between 6/8/18 - 6/15/18

- Displays the bid-offer spread by sector between 6/8/18 - 6/15/18

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or 646-699-5041.