Our monthly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a monthly period.

- Top 20 Largest Loans

- Top 20 Loan Price Losers

- Average Bid Price (By industry sector)

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

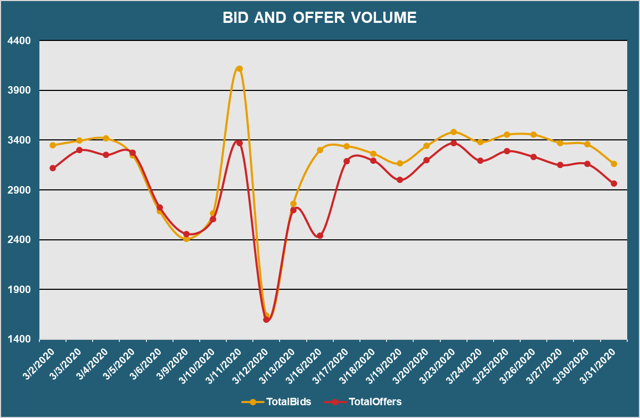

- Bid and Offer Volume

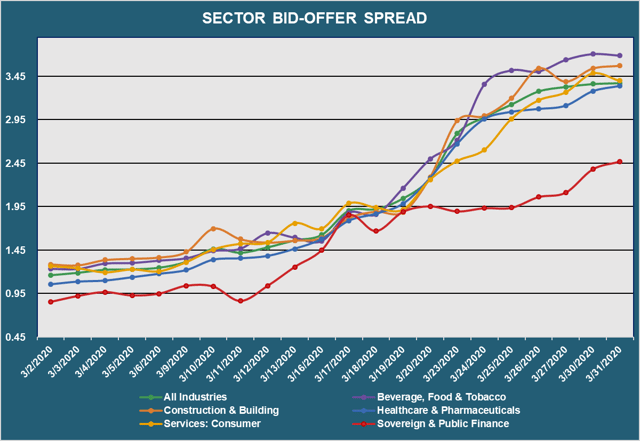

- Bid Offer Spread (By industry sector)

| LARGEST LOANS | ||||||

| Rank | Size (MM) | Name | Chg | Price | Price - 1W | Dealers |

| 1 | 4,197 | AKZONOBEL TL B | -12.08% | 87.31 | 99.31 | 13 |

| 2 | 3,843 | CHANGE HEALTHCARE TL B | -7.61% | 91.54 | 99.08 | 11 |

| 3 | 3,415 | ENDO HEALTH TL B | -9.77% | 87.06 | 96.50 | 12 |

| 4 | 3,325 | CINEWORLD TL B | -30.23% | 64.40 | 92.30 | 19 |

| 5 | 3,300 | BMC SOFTWARE TL B | -14.22% | 83.31 | 97.12 | 16 |

| 6 | 3,210 | HUB INTL LTD TL B | -6.13% | 93.04 | 99.12 | 11 |

| 7 | 2,525 | VODAFONE TL | -5.47% | 91.97 | 97.29 | 14 |

| 8 | 2,250 | ZIGGO EUR TL H | -9.68% | 89.78 | 99.40 | 11 |

| 9 | 2,210 | TRANSDIGM INC. TL E | -6.22% | 91.49 | 97.56 | 15 |

| 10 | 2,180 | FRONERI EUR TL B | -7.92% | 91.69 | 99.57 | 14 |

| 11 | 2,105 | STADA ARZNEIMITTEL EUR TL F | -13.14% | 86.10 | 99.12 | 11 |

| 12 | 2,101 | IHEART TL B | -16.63% | 83.40 | 100.03 | 10 |

| 13 | 2,000 | CEVA SANTE ANIMALE EUR TL B | -13.05% | 87.07 | 100.14 | 13 |

| 14 | 1,955 | POWER SOLUTIONS EUR TL B | -14.34% | 85.47 | 99.77 | 11 |

| 15 | 1,900 | TDC EUR TL B | -8.85% | 90.26 | 99.02 | 11 |

| 16 | 1,900 | GARDNER DENVER TL B | -12.30% | 87.31 | 99.55 | 12 |

| 17 | 1,860 | NETS HOLDINGS EUR TL B1 | -12.83% | 86.74 | 99.51 | 12 |

| 18 | 1,800 | UNITED NATURAL FOODS TL B | -5.35% | 82.87 | 87.56 | 13 |

| 19 | 1,778 | TRANSDIGM INC. TL G | -6.20% | 91.57 | 97.62 | 16 |

| 20 | 1,702 | BUCCANEER TL | -31.33% | 62.91 | 91.61 | 12 |

| AVERAGE | 2,478 | -12.17% | 85.76 | 97.56 | 12.9 | |

- Highlights the weekly price movements and quote depth for the 20 largest bank loans

| TOP 20 LOSERS | ||||

| Rank | Loan | Chg | Price | Price - 1M |

| 1 | 24 HOUR FITNESS TL B | -72.39% | 20.05 | 72.63 |

| 2 | CALIFORNIA RESOURCES TL | -68.00% | 28.18 | 88.05 |

| 3 | UTEX TL B | -63.10% | 30.63 | 83.01 |

| 4 | CHESAPEAKE ENERGY TL | -60.26% | 38.65 | 97.23 |

| 5 | TRAVELPORT 2ND LIEN TL | -56.63% | 35.35 | 81.50 |

| 6 | FIELDWOOD ENERGY TL | -55.13% | 36.89 | 82.21 |

| 7 | ASCENA RETAIL TL B | -55.00% | 29.54 | 65.64 |

| 8 | CIRQUE DE SOLEIL TL B | -46.48% | 50.29 | 93.96 |

| 9 | INTERNAP PIK TL B | -52.98% | 25.38 | 53.98 |

| 10 | JC PENNEY TL B | -52.92% | 41.50 | 88.15 |

| 11 | CRESTWOOD MIDSTREAM TL B | -52.00% | 45.17 | 94.10 |

| 12 | JASON INC 2ND LIEN TL | -51.39% | 30.00 | 61.71 |

| 13 | STETSON MIDSTREAM TL B | -51.30% | 44.44 | 91.25 |

| 14 | MENS WEARHOUSE TL B | -51.06% | 36.67 | 74.92 |

| 15 | JO-ANN STORES TL B | -51.15% | 35.21 | 72.07 |

| 16 | NEIMAN MARCUS TL | -48.67% | 41.73 | 81.31 |

| 17 | KCA DEUTAG TL B | -48.42% | 35.44 | 68.71 |

| 18 | EAGLECLAW TL B | -48.24% | 46.15 | 89.17 |

| 19 | TALLGRASS TL B | -48.13% | 51.12 | 98.54 |

| 20 | TNT CRANE 2ND LIEN TL | -47.97% | 30.15 | 57.94 |

- Showcases the top 20 loan "losers" based on the largest bid price decreases for the period between 3/1/20 - 3/31/20

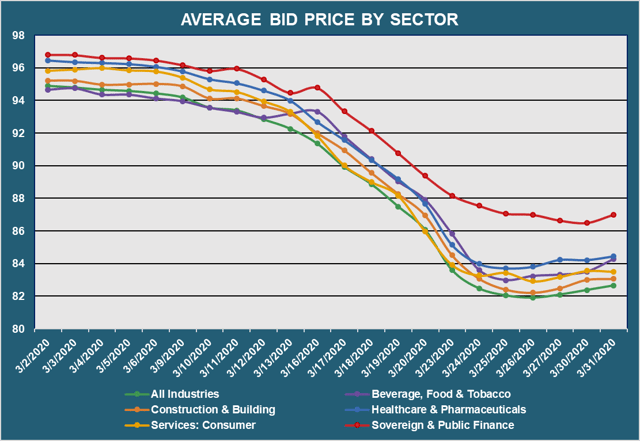

- Displays the average loan bid price by sector for the period between 3/1/20 - 3/31/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

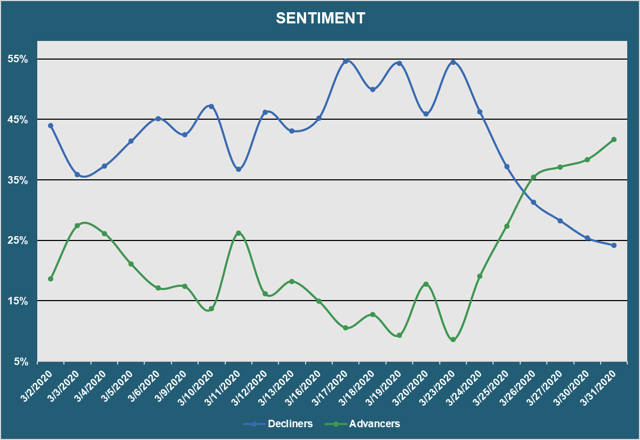

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) for the period between 3/1/20 - 3/31/20

| TOP QUOTE VOLUME MOVERS: THIS MONTH vs LAST MONTH | |||||

| RANK | TRANCHE |

PRIOR MONTH |

THIS MONTH |

INCREASE | % INCREASE |

| 1 | TRANSDIGM INC. TL F | 112 | 238 | 126 | 113% |

| 2 | CALPINE CORP TL B9 | 66 | 164 | 98 | 148% |

| 3 | INTEGER TL B | 0 | 89 | 89 | N/A |

| 4 | FIRST EAGLE TL B | 73 | 154 | 81 | 111% |

| 5 | TRANSDIGM INC. TL G | 161 | 237 | 76 | 47% |

| 6 | TRANSDIGM INC. TL E | 165 | 239 | 74 | 45% |

| 7 | DAVITA TL B | 148 | 214 | 66 | 45% |

| 8 | PETSMART CONSENTED TL B2 | 58 | 121 | 63 | 109% |

| 9 | FRONERI TL B | 40 | 100 | 60 | 150% |

| 10 | AVIS BUDGET TL B | 10 | 66 | 56 | 560% |

- Exhibits the loans with the largest increase in quote volume for the month ending 2/29/20 vs. the month ending 3/31/20

- Includes only loans outstanding

| MOST QUOTED LOANS | ||

| RANK | TRANCHE | DEALERS |

| 1 | CASINO GUICHARD EUR TL B | 15 |

| 2 | TECHEM EUR TL B | 15 |

| 3 | KLOECKNER EUR TL B | 12 |

| 4 | VERISURE EUR TL B | 12 |

| 5 | SANDY CREEK TL B | 12 |

| 6 | CERAMTEC EUR TL B | 12 |

| 7 | NESTLE SKIN HEALTH EUR TL B | 12 |

| 8 | MASMOVIL IBERCOM SA EUR TL B | 12 |

| 7 | DORNA SPORTS EUR TL B | 12 |

| 10 | WEBHELP EUR TL B | 12 |

- Ranks the loans that were quoted by the highest number of dealers for the period between 3/1/20 - 3/31/20

- Reveals the total number of quotes by bid and offer for the period between 3/1/20 - 3/31/20

- Displays the bid-offer spread by sector between 3/1/20 - 3/31/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.